Author:Cold Wind Meta

author:Anthony PomplianoFounder and CEO of Professional Capital Management; Translated by Shaw, Jinse Finance

Federal Reserve Chairman Jerome Powell and the Federal Open Market Committee (FOMC) began a two-day meeting, with markets closely watching whether the Fed will cut interest rates.

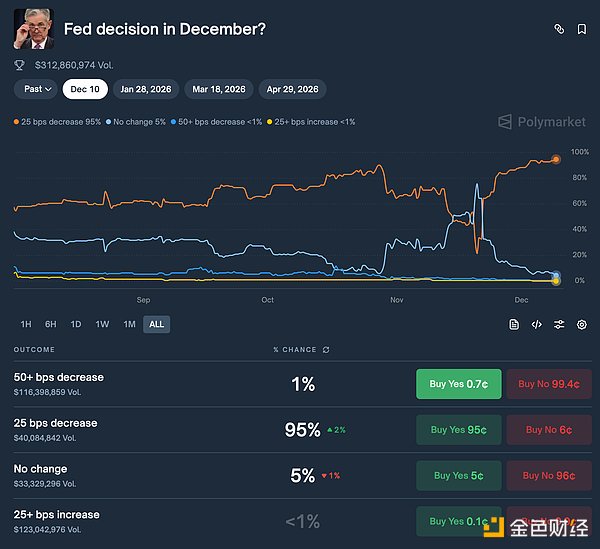

On Polymarket, the odds of a 25 basis point rate cut have risen to 95%, while the probability of no change is 5%..

If the Federal Reserve cuts interest rates, this will be the third consecutive rate cut this year.(Following the 25 basis point rate cuts in September and October), even if inflation remains high, the rate cuts will act as an "insurance" measure to address the escalating risks in the labor market.

But I would like to explain why the Federal Reserve should actually cut interest rates by 50 basis points tomorrow. First, we know...The labor market is weakening, and if not addressed proactively, it could trigger concerns about a full-blown economic slowdown or even recession.

Nonfarm payrolls increased by only 119,000 in September, a significant slowdown from the post-pandemic average and below expectations. As a result, the unemployment rate rose slightly to 4.4%.

So far this year, the number of layoff announcements has surged to 1.17 million, the highest level since the outbreak of the pandemic in 2020. Meanwhile, hiring plans have reportedly fallen to their lowest level since the end of the financial crisis.

Finally, private sector indicators, such as the November ADP employment data and the Challenger layoffs report, weakened further. These trends suggest that...Job growth is insufficient to match the expansion of the labor force.Given the situation in the labor market, the rationale for advocating a 50 basis point interest rate cut is that...Larger interest rate cuts would help employment and prevent a vicious cycle of reduced consumption and further hiring freezes.

However, the arguments for a 50-basis-point rate cut do not solely depend on the labor market.

I thinkThe government's published inflation figures significantly overestimated the inflation level, which provides support for a larger interest rate cut.Core personal consumption expenditures (PCE) inflation is currently around 3% (about 1% above the target), but deflationary factors have mitigated the risk of inflation accelerating again. This should allow the Federal Reserve to focus its efforts on its dual mandate of employment.

Critics claim that commodity prices remain high due to tariffs and fiscal stimulus, butFalling crude oil prices, an oversupply of rental housing, and declining home prices have created a risk of deflation.In my view, this gives the green light for a more significant interest rate cut.

In addition to the factors mentioned above, both the Federal Reserve's forecasts and market-implied inflation expectations have remained stable at around 2%. This is clearly lower than the nearly 4% level predicted by consumer surveys, but we know that these surveys are biased and may deviate further from market consensus.A 50-basis-point rate cut aligns with the Fed's October statement that it would "adjust policy as appropriate should risks arise." Therefore, the Fed could interpret a larger rate cut as targeted support rather than a policy shift.

Therefore, we face a weak labor market and an inflationary environment, but ultimately, the decision to cut interest rates by more than 25 basis points still needs to be made by the members of the FOMC.

Fortunately, there are also some pragmatic individuals within the Federal Reserve who seem to believe that larger rate cuts would be beneficial. We know that there are currently serious divisions within the Fed, which could foreshadow a surprisingly large rate cut.

Federal Reserve Governor Stephen MilanHe has opposed the move on both recent occasions, advocating for a 50-basis-point rate cut. In November, he stated that a significant rate cut in December would be "appropriate" to address labor market risks. At that time, he indicated that a December rate cut would be "at least 25 basis points, but without new information… 50 basis points would be appropriate."

Milan is not the only one who holds this view.John Williams, President of the Federal Reserve Bank of New YorkandSan Francisco Federal Reserve President Mary DalyThey all expressed support for loose monetary policy. Williams explicitly stated that he believes interest rate cuts are "insurance" to prevent a decline in the labor market without jeopardizing the inflation target.

So, what changes do analysts predict will occur within the Federal Reserve?

Nomura Securities analysts predict that Milan will take a dovish stance, advocating for a 50 basis point rate cut, while other committee members may take a hawkish stance, even opposing a 25 basis point cut. This highlights a rare division among committee members on the issue of easing policy.

Such internal dynamics are extremely rare, because we have almost never seen such a large degree of disagreement in the past 35 years.This could prompt policymakers to take bolder action or cut interest rates more drastically.

So what are my expectations?

I believe the final rate cut will only be 25 basis points. I would prefer a 50 basis point cut, but I don't see the Federal Reserve having enough power to take more aggressive measures. Market dynamics suggest that the rate cut should be larger. The economy would also benefit from a larger rate cut. Unfortunately,The Fed's strategy is too conservativeThey are afraid to face themselves, let alone make bold decisions.

We're all waiting for the results. The Federal Reserve is holding its FOMC meeting. Trillions of dollars are being bet on what Jerome Powell will say at his press conference tomorrow.

The world will continue to turn, the U.S. economy will continue to strengthen, and the stock market will rise sharply in the coming months. The Federal Reserve cannot stop this trend, no matter how poorly they manage monetary policy.